Buying a new property can be very exciting yet a bit nerve-racking, especially if you are a first-time buyer. It is vital to know not only the usual/customary steps such as choosing the right mortgage and arranging a solicitor, but also the often forgotten or less obvious considerations when buying a property in 2018.

With the recent news that first-time buyers could see a stamp duty cut, timing becomes critical in purchasing a property. If you are in a hurry to buy and can’t afford wasting any time for the government to decide, this is everything you need to know about the current stamp duty land tax.

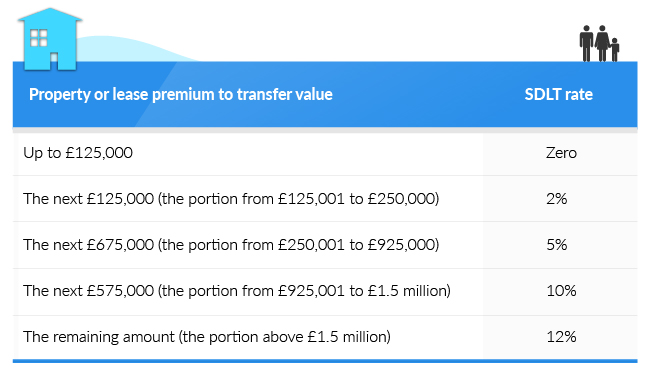

If you opt for a residential property you should expect to pay the following SDLT rates for both freehold and leasehold sales:

If you choose a leasehold property and if the net present value is more than £125,000 you are also expected to pay SDLT of 1% on the portion over £125,000. This is not the case if you buy an existing ‘assigned’ lease.

For more information about leasehold properties go to https://www.gov.uk/leasehold-property

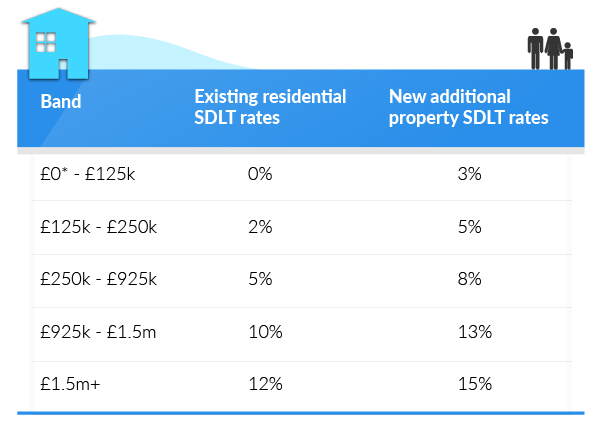

If you already own a property and are looking to buy another one you’ll have to pay 3% on top of the normal SDLT rates which are as following:

If you are looking to replace your main residence, you will NOT have to pay the extra 3% SDLT if your main property has been sold before the purchase of the new property. The extra 3% only applies if you own more than one property.

You need to send an SDLT return to HMRC and pay the tax within 30 days of completion.

If you are working with a solicitor, agent or conveyancer, they would usually pay the tax and send the SLDT return on your behalf.

With the predicted house price rises peaking around the corner, potential buyers can find themselves overwhelmed with the costs, therefore choose to apply for a Help to Buy Equity scheme; initiative set up by the government. Although they are enticing and are meant to accelerate the process of buying a home, you need to be aware of the least appealing parts of these schemes as well.

For more information on the Help to Buy Equity scheme visit https://www.gov.uk/affordable-home-ownership-schemes/help-to-buy-equity-loan

Another option for first time buyers is the Help to Buy ISA scheme. This is a tax-free savings account designed to help first-time buyers purchase a property. The government will top up your savings by 25% (up to £3,000) when you are saving to buy your first home.

For more information on the Help to Buy ISA scheme visit: https://www.gov.uk/affordable-home-ownership-schemes/help-to-buy-isa

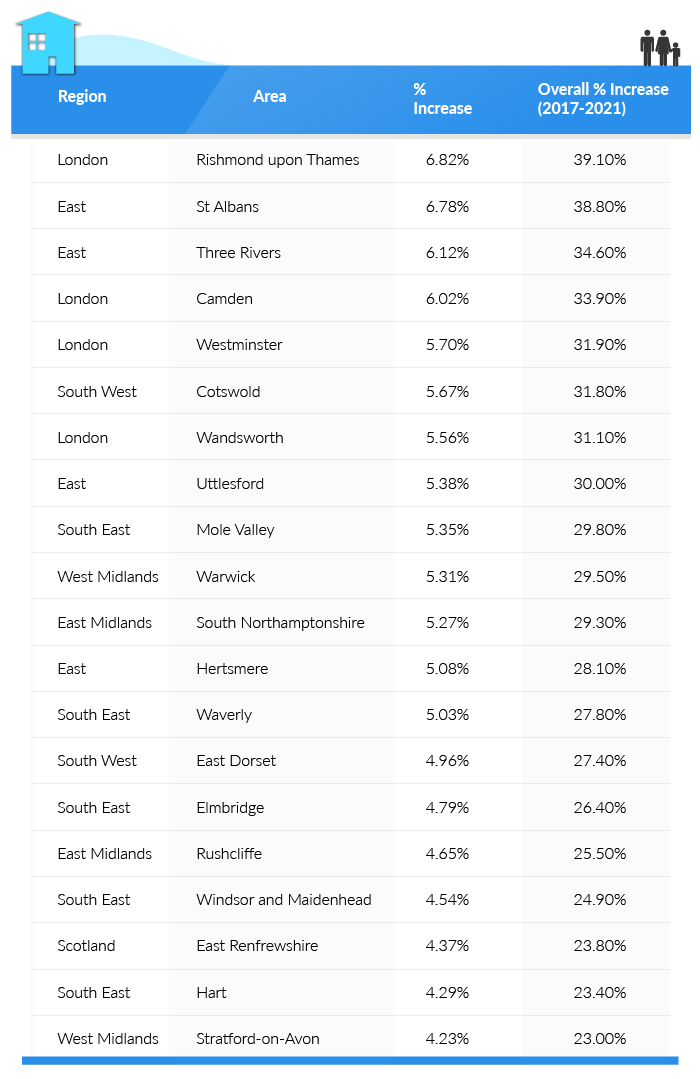

In the research conducted by Barclays Property Indicator predicts a 6.1% house price rise over the next 5 years. The research involved analysing data from 12 key indicators including: rental increases, employment levels, past trends on property prices, earning levels, commuting patterns and projected population growth. As a result, they anticipate the following property investment hotspots:

On your way to your viewing make sure you take a close look at the neighbourhood. Perhaps before the viewing, you have already checked the crime statistics for the area, often available on estate agent websites. But when driving through the area, take a closer look at the surroundings; what shops are available, young or old demographic, is it clean or dirty - it is important to see it all for yourself. The devil is in the detail, so keep an eye out for anything that might be a concern: Are walls scrawled with graffiti? Are the cars clean and well-maintained? Are there any schools around?

Another tip is to check what’s being built in the area. Some changes might not be to your liking or on the contrary, they can make the neighbourhood even more desirable, so make sure to check the Government Planning Portal for details of ongoing or upcoming projects in your area. Bearing in mind, any new projects can add value to your home, and area as a whole.

When looking for potential pitfalls on a property, it is useful to have a friend or a specialist with you who can identify any major issues with the property and to give you an honest opinion on the property. A small issue such as a broken door handle shouldn’t be a deal-breaker but keep an eye out for the following issues which could become a cause for concern:

After viewing a handful of properties your memory may play games with you, causing you to forget important details or mix it up with other properties you saw. A way to keep the memory alive is to take pictures. Most sellers understand that photos are must-have when visiting a property, but make sure to ask first to avoid any potential problems.

Plans can change and one day you might find yourself in the position where you want to sell your property, and that’s why considering its resale potential is important when buying. The number one factor that can guarantee the resale potential is the location. If you buy a home in a desirable location, chances are it will remain favourable. Another way of maximizing the resale potential is by maintaining the interior and exterior of the property to high standards in order to avoid ‘deal-breakers’, which may deter any future prospective homebuyers looking at your home.

It’s easy to become carried away when buying new pieces of furniture for your home, but perhaps your vendor is planning on leaving some fixtures behind? Ask the vendor, or estate agent, to give you a written list of all fixtures and fittings included in the purchase. This could include blinds, washing machine, fridge freezer. And considering, home fixtures and fittings can add up to thousands of pounds, having it included in the asking price is a no brainer for future homeowners, looking to save some cash in the process and will make a big difference to the monetary worth of a property.