Each year, more than 1 million Brits face a dilemma whether to buy a brand-new home or an existing property. Both new and older homes have their advantages and disadvantages; new-builds are a lot easier to buy – especially for first-time buyers thanks to various government Help to Buy schemes but they are on average more expensive than the existing properties. Compared to new-builds, older homes also tend to have more space for the price but they carry a risk of hidden costs which can significantly increase the overall price. Deciding between a new-build and an existing property is thus everything but easy.

Fasthomes looked at the Land Registry’s data to see which type of property prevails in the end: new-builds or established residential buildings. The researchers at Fasthomes found that of total 262,981 properties sold in 25 major cities in England and Wales in 2016, 36,179 were new-builds and 226,802 were existing residential buildings. This means that only 13.7% of homebuyers bought a brand-new home rather than a “home with character”.

Unsurprisingly, the largest number of both new-builds and established residential buildings were sold in London. Out of a total 73,066 properties sold in the UK capital in 2016, 58,475 were existing homes, and 14,591 were new-builds. This means that 80% of Londoners who decided to make a big move chose existing properties over new-builds. These accounted for 20% of all properties sold in 2016.

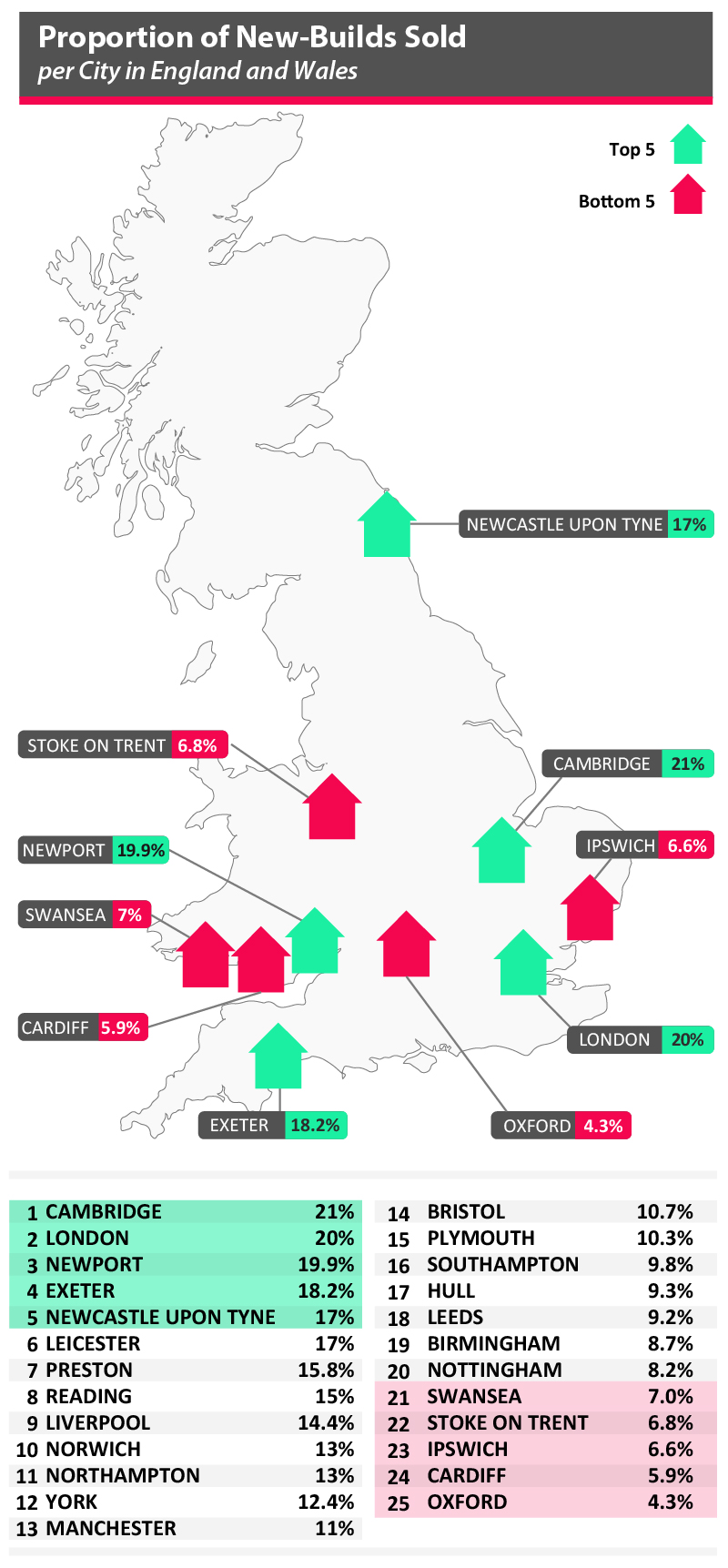

Fasthomes’ analysis of the data for other major cities in Britain reveals that the preference of “homes with character” isn’t just a London thing. On the contrary, homebuyers prefer existing properties over their newly built counterparts in other cities as well.

In some cities, new-builds accounted even less than 10% of all properties sold in 2016. They include Oxford (4.3%), Cardiff (5.9%), Ipswich (6.6%), Stoke-on-Trent (6.8%), Swansea (7%), Nottingham (8.2%), Birmingham (8.7%), Leeds (9.2%), Hull (9.3%) and Southampton (9.8%). Brand new homes were only slightly more popular in Plymouth (10.3%), Bristol (10.7%) and Manchester (11%), while Newcastle upon Tyne (17%) and Leicester (17%), Exeter (18.2%), Newport (19.9%) and Cambridge (21%) were closer to the “London level”.

Fasthomes’ researchers also looked at the data for the price paid for new-builds in 25 major cities in England and Wales. At an average price of £694,783, London was the most expensive place to buy a new home in 2016 and exceeded the average new-build price of the second most expensive city – Cambridge (£481,893) for more than 40%. At the average price of £472,634, Oxford is just behind Cambridge, while homes in Reading average at £357,325 falling behind the top three most expensive cities to buy a new home.

In 2016, new-builds were the least expensive in Liverpool with an average price paid of £143,413, which is nearly 5-times less expensive than in the UK capital. Other major cities with the most affordable new homes include Hull (£161,303), Preston (£181,445), Manchester (£184,966), Newcastle upon Type (£184,976) and Ipswich (£192,955), all falling below the £200,000 price mark.

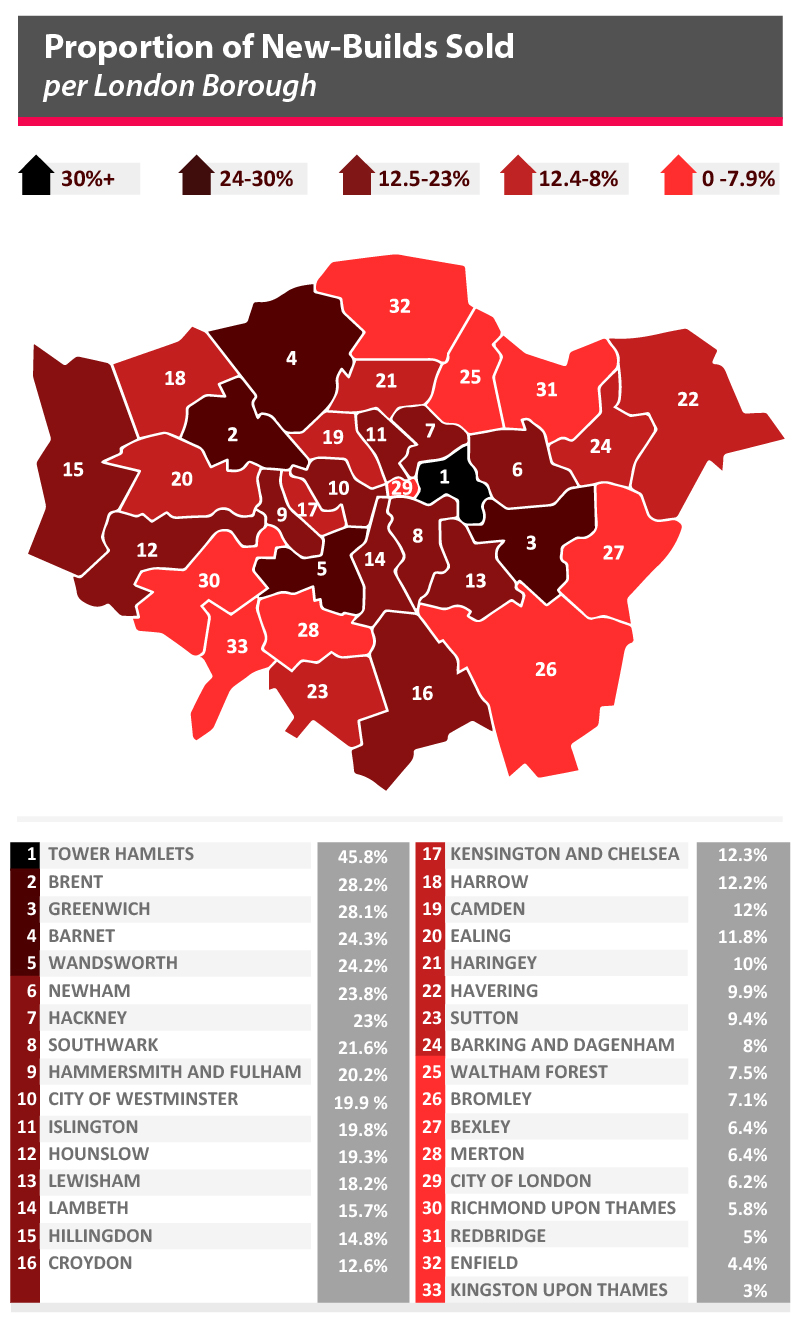

Fasthomes’ analysis of the Land Registry’s data for London reveals a major difference in the proportion and price of new-builds that were sold in 2016; far greater than the selected 25 cities in England and Wales.

While new-builds accounted for 45.8% of all sold properties in the London borough of Tower Hamlets, only 3% of homebuyers moved into a brand-new home in Kingston upon Thames. The proportion of homebuyers selecting a new-build over an existing property was only slightly higher in Enfield (4.4%), Redbridge (5%), Richmond upon Thames (5.8%) and City of London (6.2%). After Tower Hamlets, brand new homes were the most popular in Brent where they accounted for 28.2% of all properties sold, followed by Greenwich (28.1%), Barnet (24.3%) and Wandsworth (24.2%).

The researchers also observed a major difference between London boroughs when assessing the average price paid for a new-build in 2016. Making the big move was expectedly the most expensive for those who bought a new home in Kensington and Chelsea. Home in this borough were on average sold for £1,995,523. At an average price paid of £1,837,317, the City of Westminster fell closely behind, followed by City of London at £1,552,634, Hammersmith and Fulham at 1,098,968 and Camden at £957,224. For the average price paid in Kensington and Chelsea, buyers could get as many as 7 brand new homes in Havering where the average price paid in 2016 reached “only” £283,439. Other London boroughs with the most affordable new-builds in 2016 were Sutton (£310,004), Barking and Dagenham (£324,964), Croydon (£333,362) and Redbridge (£342,535).

The results of Fasthomes’ research raise the question: Why British homebuyers prefer existing properties over new-build homes?

“Buying an existing property offers several advantages over a brand-new home. Firstly, there is the price factor as new-builds are on average more expensive. Secondly, old homes – especially those built before 1980 tend to be bigger than new-builds. And finally, there are simply not enough new homes.

According to some estimates, the UK is short of some 100,000 homes a year when it comes to the ratio between the supply and demand of new-builds. Until the gap between the demand and supply of new homes closes, we can’t really expect any major changes in the housing market when it comes to new-builds vs. existing properties”.