If you need to sell your house fast, you may be tempted to use a ‘quick house sale’ company. Companies, such as webuyanyhome, claim to be able to buy your house and give you cash in as little as a week, however this often means losing out on the actual house value. Before you begin this process, you should ensure you carry out your research to avoid being misled and even worse, out of pocket.

Quick house sale firms are a new breed of business promising to help you sell your home fast, by either buying your home directly or finding a third-party homebuyer, and offering up to 90% of your home’s value. These companies appeal to buyers who need to move fast and are especially popular with struggling homeowners needing to sell their property quickly.

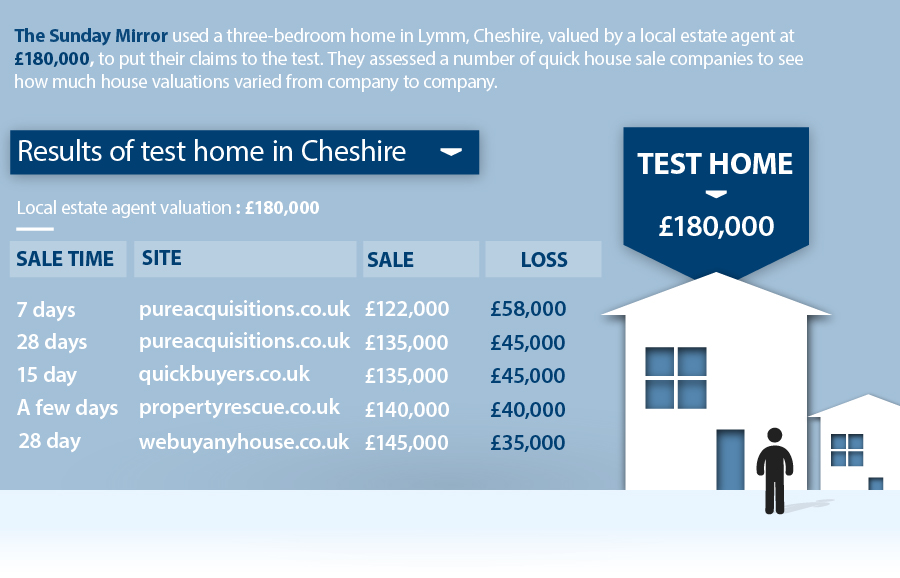

Despite the fact quick sale businesses sound promising, they can often be a rip off. A large majority of quick house sale companies state they will only knock 10% off the market value of your home, however studies have found this figure is likely to be much higher – sometimes as high as 50%!

In a study by the Independent, a two-bedroom maisonette in West London was valued by two local estate agents at an impressive £475,000 to £500,000 price range. However, an online quote by a quick house sale company estimated the property was as low as £337,500.

Dean Heaviside, a director of Fine Estate Agents, said that: “Vendors need to realise that an offer to pay '90 per cent of the current market value' is only 90 per cent of its interpretation of the property's market value – which is often far lower than its real worth – sometimes by as much as 30 per cent."

Quick house sale companies can be useful in some instances when homeowners need cash as soon as possible. It is in these instances that people get conned. According to the Office of Fair Trading (OFT), “70% of the complaints received about quick house sales came from vulnerable homeowners who may be particularly attracted by claims of hassle-free service, with no viewings or hold-ups”.

People may turn to quick house sales to:

However, there are disadvantages to using quick sale companies:

If you would like to sell your house using a quick sale company in order to sell your property quickly, you run the risk of being significantly underpaid for the price of your home or being tricked for less money than you were intending to receive.

A television advertisement claimed Gateway Homes UK could sell your property and be “finalised in as little as seven days”. This is far from the truth as trading standards received 40 separate complaints about the company for delays in sales and sudden price drops.

To ensure the company is registered and legal, you should check on Companies House to see if they are legitimate, how long they have been trading for, and how much its annual turnover is. Beware, if a company is not registered, alarm bells should start to ring. Do they have something to hide?

At each stage of the process, make sure you have all the information you need and you understand everything in order to avoid being deceived and misled by the quick sale company.

Here are some questions to ask the quick sale company:

It is important to consider all other avenues before turning to quick house sale companies. They should be a last resort and should only be used when in an emergency and no other option can help you.

If you are selling to relocate due to a marriage breakdown or a new job, renting your home is another option to prevent needing a quick sale. Renting is proven to be highly popular – now more than ever – with tenant demand for rental properties increasing month by month according to a Royal Institution of Chartered Surveyors (Rics). The survey suggests that the price of rent has increased substantially, and set to increase by just over 25% in the coming years, while property values are set to grow by less than 20%.

If you want a quick sale but have insufficient equity, consider using an auction house to sell your home. This is a quick, straightforward way to sell your home fast, but it does require paying advertisement and commission costs, which tend to be 2.5% of the price your property is sold for. Before the auction date, you should have a valuation by a local estate agent, and have a set reserve price in place (the minimum amount the property can sell for). Once the hammer falls, the bidder is legally contracted to buy your home and give you a 10% deposit.

You may decide you don’t want to use a local estate agent because they are too time consuming, but this doesn’t have to be the case. Speak to a local estate agent and explain that you want a fast sale, but as close to the market value as possible. It is sometimes worth considering giving the estate agent an incentive, such as an extra per cent or two, if you exchange within a specific time frame.

If you are not satisfied with the service provided by a quick house sale company, you should tell them and get them to investigate the matter. The company should resolve your complaint, however if this does not happen, you can refer the matter to the independent property complaints service, such as The Property Ombudsman or Ombudsman Services: Property.

Alternatively, Citizens Advice are available to give you advice on your issue whenever you need it regarding housing matters. You can either contact them or visit your local Citizens Advice Bureau – find yours here.

Vendors who use quick house sale companies sacrifice between 10 and 25% of the market value of their property. In some cases, the OFT found that the reductions were for more than half the value with the average quick sale price estimated, at around £100,000.

“I lost 40% on my quick house sale”

Anne Baker had been trying to sell a property she inherited in Yorkshire for more than a year when she and her husband turned to a quick house sale company. The company, Gateway Homes, valued the property at £100,000 and offered to sell it within two weeks for a sale price of £75,000. But 10 weeks later, the property had still not been sold and the company lowered the property price to £60,000. The house was costing the Baker family insurance and tax bills, so Mrs Baker reluctantly accepted their offer and they had completed within two days.

Mrs Baker said: “We were lucky that it wasn’t our main home, but the process was very stressful. I was ringing them at least once a week. We were disgusted with the way we had been treated; I certainly wouldn’t recommend it to anybody.”

it is important to understand that not all quick house sale companies try to mislead you. In some instances, people who may want to sell their property quickly, due to a number of circumstances, are able to – and hassle-free.

“My house was sold in 12 days!”

A quick house sale website, Genuine Property Buyers, was contacted by a woman from Los Angeles to enquire about selling a home in Doncaster which belonged to her grandparents. After clarifying all of the relevant details about the house, including the number of rooms, condition of the home and average specification. On the third day, an offer was received that was 15% below the asking price for the house. On day 6 the offer was accepted, and six days later, the property was sold.